Introduction

The Netspend API gives the partner the ability to create an additional added benefit to the customer by way of an overdraft protection feature they can offer to their account holders. Account Holders can choose to enroll in the Overdraft feature for their account, which enables them to overdraw their account with some reasonable constraints.

Note: The Overdraft feature is funded by Netspend, bank-sponsored, and offered on a discretionary basis.

Following are the overdraft features:

- The Overdraft feature is optional with the ability to unenroll (opt out) at any time without penalty

- All overdraft transactions have a grace period, a no-fee buffer, and a low-cost fee structure including fee caps (monthly and annually).

- Discretionary by the Financial Institution (FI), and not guaranteed.

- Not a line of credit.

Enrollment and Limitations

For an account to be enrolled in overdraft:

- The account holder has to voluntarily choose to enroll (opt in) in the overdraft service

- The account holder must pass standard eligibility criteria.

- The account holder must agree to all Terms & Conditions (T&Cs), which generally include stipulations like the following:

- ACH debit transactions, including those initiated through third-party bill pay service providers, are not covered by the overdraft feature

- An Overdraft Fee pends when the transaction takes the Available Balance negative beyond the Fee Buffer.

- An overdraft fee is applied to each transaction that overdraws the account Actual Balance by more than the buffer amount ($10.00) or for more time than the grace period (24 hours). However, note that an overdraft fee will not be applied if the customer:

- Cures the negative balance within the 24 hour grace period that is initiated with the first settled transaction that takes the account actual balance negative greater than the fee buffer

- Has reached the monthly fee cap

- An account can incur a maximum number of overdraft fees per month, or per year (5 per month, or 45 per year)

For the overdraft feature to remain active after enrollment, the following ongoing eligibility criteria are to be met:

- The account must receive direct deposits as specified. Direct deposits are immediately applied to any negative balance before the account holder has access to the funds.

- The account must receive direct deposits that cumulatively reach the direct deposit threshold, each 35 days.

- The Overdraft feature is not manually suspended or temporarily deactivated. Suspension occurs if the customer does not meet the ongoing eligibility requirements, or hits timed negative balance thresholds (for example, if the account has been negative 1x60 days or 3x30 days); or if a written-off negative balance has been recovered). Deactivation occurs if the eligibility requirements are not met within the time thresholds. Temporary Suspensions (cooling off) occur if the account has been assessed 20 overdraft fees.

Time Periods for Overdraft

Grace Periods

When the first overdraft occurs resulting in a negative actual balance beyond the fee buffer, the 24-hour grace period is initiated.

If the account holder rectifies the negative balance during the grace period, then overdraft service fees are not applied. If the account holder’s account balance is still negative during the grace period, then the overdraft service fee is applied for each overdraft instance after the grace period ends.

The account is not eligible for another grace period until after the negative balance is corrected.

Fee Caps and Their Time Periods

Fee caps are set at the bank level. If the monthly fee cap is reached, the overdraft feature can still be used to the overdraft limit and no overdraft service fee is charged for the transaction.

Monthly Fee Caps

The monthly fee cap is 5 Overdraft service fees in 1 month.

Annual Fee Caps

If an account reaches the annual overdraft fee cap prior to the end of an annual period, the Overdraft feature is suspended for the remainder of the applicable annual period. When the annual period ends, the account’s annual fee cap is reset and the Overdraft feature is available for use for accounts that meet the eligibility requirements. If the account does not meet the ongoing eligibility requirements, after the annual period ends, the account holder needs to meet all eligibility requirements and enroll or re-enroll in the Overdraft feature again and the Overdraft feature is reactivated.

Cooling Off Period

Accounts that incur 20 overdraft fees in a rollling 12-month (365 day) period have their overdraft feature suspended: Two cooling off periods exist; the first occurrence is 35 days and subsequent periods are for 45 days.

Initial Cooling Off

The Overdraft feature is suspended for a period of 35 days beginning after the 20th overdraft service fee is assessed. At the conclusion of the suspension period, the Overdraft feature is automatically reactivated for accounts that meet all eligibility requirements, including required direct deposit activity.

Ongoing Cooling Off

The Overdraft feature is suspended for a period of 45 days beginning after the 20th overdraft service fee is assessed. At the conclusion of the suspension period, the Overdraft feature is automatically reactivated for accounts that meet all eligibility requirements, including required direct deposit activity. Initial cooling off is referred to as “Temporarily Suspended” in the Online Account Center (OAC).

The OAC is a browser-based application where cardholders can manage their prepaid cards.

Suspension of Overdraft

After the account holder has enrolled and met all of the initial and ongoing eligibility requirements, an account’s Overdraft feature can be suspended for the following reasons:

- Direct deposit is missed

- The account has 3 occurrences of a negative balance for 30 days

- Start date of suspension is the 30th day of the 3rd negative balance

- End date is 6 months later (180 days from the start date)

- The account has 1 occurrence of a negative balance for 60 days

- Start date of suspension is the 60th day of the 1st negative balance

- End date is 6 months later (180 days from the start date)

- After a charge-off recovery

- Start date of suspension is the date of write off recovery date

- End date is 6 months later (180 days from the start date)

Email Communication to the Account Holder

Netspend sends the following email notifications to the account holder for all account overdraft feature activities:

| Email Name | Account Holder's Action |

|---|---|

| Overdraft Opt In | Account holder enrolls in the overdraft service |

| Overdraft Opt Out | Account holder unenrolls from the overdraft service |

| Overdraft Deactivation Notification | Overdraft Service has been deactivated due to eligibility lapse (Direct Deposit requirements). When the account holder meets eligibility again, they can choose to enroll again. |

| Overdraft Transaction with No Fee | Account holder conducts a transaction that results in a negative balance of less than the fee buffer with no overdraft service fee. |

| Overdraft Fee Assess | Account holder conducts a transaction that results in a negative balance with an overdraft service fee. The notice includes grace period verbiage encouraging customers to utilize grace period features to avoid overdraft service fee. |

| Overdraft Fee Graced Notification | Account holder conducts a transaction that results in a negative balance of less than the fee buffer with no overdraft service fee. |

| Overdraft Activated Notification has Grace Period | Account holder triggers the grace period and is eligible to cure negative balance and avoid overdraft service fee. Notification informs the account holder where and when the transaction occurred, its amount, when the grace period will expire (if applicable), any overdraft service fee applied (if the grace period has expired), and how to contact Netspend if there is a question about the transaction. |

| Overdraft Cooling Off Notification | Sent when the account holder incurs the 20th overdraft fee for which a customer incurs in less than 12 months from their enrollment date or the end date of their cooling off period. Notice includes the beginning and ending date of the cooling off period. |

| Overdraft Deactivation (180 Days) | Overdraft feature is suspended for 180 days for negative balance 3 times for 30 days, 1 time for 60 days or a written off negative balance. |

| Overdraft Habitual Use Email | Initial notice is sent to any account holder who has incurred 6 overdraft service fees in the prior rolling 12-month period. Following the assessment of the 6th overdraft service fee, the counter of the fees starts again. After the account holder incurs another 6 overdraft service fees, the system determines whether those fees were incurred in a prior rolling 12-month period. If so, the system generates another notice and the counter starts over again. Notice is sent on the 1st day of the calendar month following month in which the 6th Overdraft Service Fee was incurred. |

| Overdraft Annual Fee Cap | Account has had 45 Overdraft fees in a 12-month period an has been unsubscribed from the Overdraft feature until the next anniversary date. |

Sample Flows

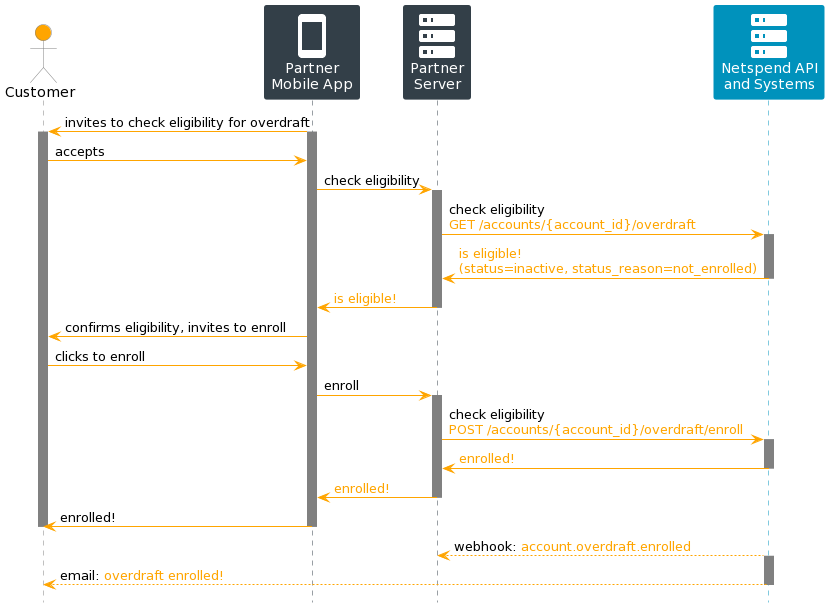

Account Enrolls in Overdraft

In this sample scenario, the partner’s phone app invites the end user to check their eligibility for their overdraft feature prior to enrollment.

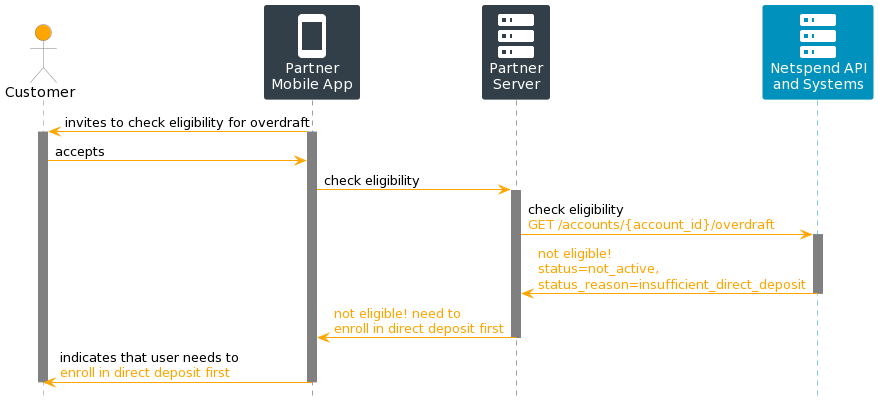

Account Fails to Activate

In this sample scenario, the partner’s phone app invites the end user to check their eligibility, but it returns an error because the user has not yet enrolled in direct deposit, as a prerequisite for enrolling in overdraft protection. Note that a customer can enroll in the Feature, but the feature is not activated until the eligibility requirements are met. Once they are met, the feature activates and the customer is notified.

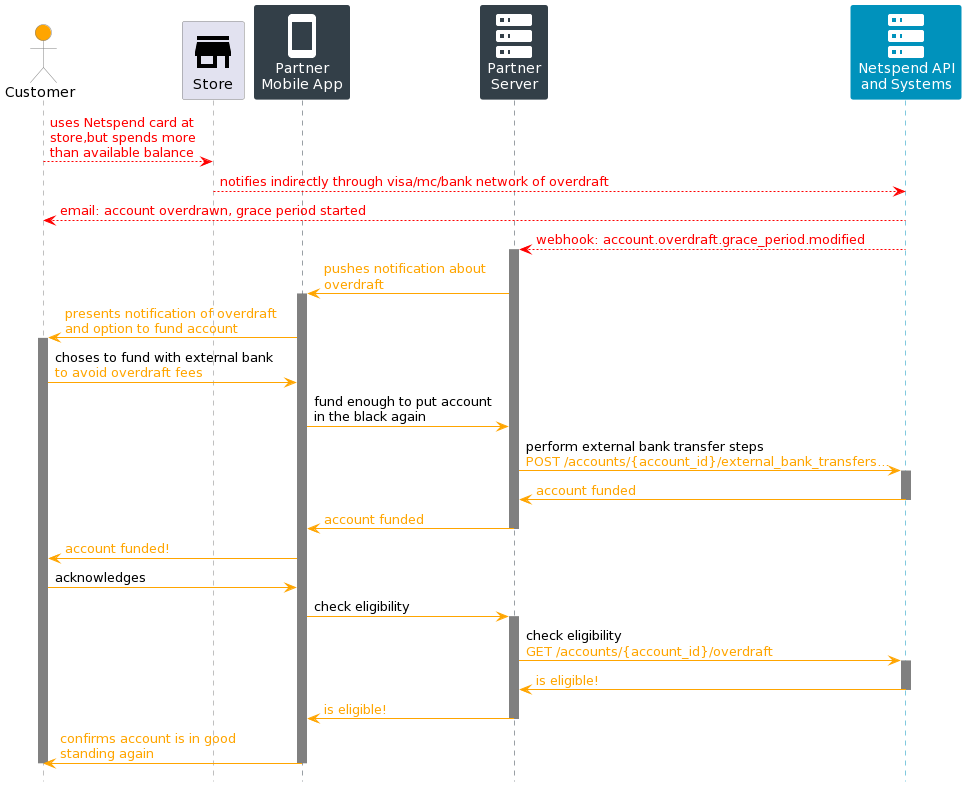

Account Triggers Overdraft

In this scenario, the end user overspends on their account, exceeding their balance, which is eventually detected by Netspend systems via Visa, MasterCard and or bank networks. The Netspend systems then send out a webhook to the partner’s back end server and an email to the customer indicating that overdraft has taken effect and there is a grace period in which the customer can fund the account before any overdraft fees are incurred. The partner server then sends a notification to the customer’s phone, where the partner application can then be used to fund the account. The customer chooses to fund using an external bank transfer to get the account back into the black, which brings the account out of overdraft and back in good standing.

Additional Use Case Scenarios

Account in Cooling Period

- The account reaches the overdraft fee threshold for the account and enters the cooling-off period.

- The Netspend API sends a account.overdraft.deactivated webhook notification to the partner, with account.overdraft in payload that shows:

- Status is inactive

- Status reason is cooled_off

- Start and end date specified

- The Netspend API sends a account.overdraft.deactivated webhook notification to the partner, with account.overdraft in payload that shows:

- Eventually, the cooling-off end date arrives

- Netspend API sends a account.overdraft.activated webhook notification to the partner, with account.overdraft in payload that shows overdraft status as active

Overdraft Suspended Due to 1x60 Days in Overdraft Status

- The account is in overdraft status for uninterrupted 60 days. On the 60th day, the overdraft feature is suspended for the following 180 days.

- The Netspend API sends a account.overdraft.deactivated webhook notification to the partner, with account.overdraft in payload that shows:

- Overdraft status as inactive

- Status reason as suspended

- Overdraft suspension start date and end date

- Note stating “suspended due to negative balance 1x60 days”

- The Netspend API sends a account.overdraft.deactivated webhook notification to the partner, with account.overdraft in payload that shows:

- After the end of the suspension period, the account holder can re-enroll

Webhooks

Payload data type: "account.overdraft"

| Webhook | Description |

|---|---|

| Account Overdraft Activated | An account's overdraft feature has transitioned into the "active" state |

| Account Overdraft Deactivated | An account's overdraft feature has transitioned into the "inactive" state |

| Account Overdraft Enrolled | An account has enrolled in an overdraft program, status may be "active" or "inactive" |

| Account Overdraft Grace Period Modified | The customer's grace period has changed statuses. |

| Account Overdraft Incurred | An account's overdraft has occurred |